How Finance Digitalization Can Revolutionize Your Financial Management

The integration of digital technology into any financial services, processes and services is referred to as "Digital Finance". It uses cutting-edge technologies, including big data analytics, cloud computing, artificial intelligence and mobile technology to improve customer satisfaction, automate and accelerate operations and enable financial professionals to create innovative work environments more, reduce costs and make better decisions through integration using digitization.

The role of financial institutions, customer interactions and value provision are changing as a result of digital technology. The financial industry is competing and adopting digital-first strategies to meet the changing needs of consumers, from online banking systems to robo-advisors and blockchain-based transactions.

Take a look at how dynamic IT services are changing many sectors and learn how innovation can help your company forward!

A growing number of people are adopting digital technologies, and consumer needs are driving digital banking. Financial services that are smooth, customized, and available on demand through digital channels are exactly what millennials and especially Gen Z are looking for. So in order to compete and satisfy their tech-savvy customers, financial institutions are investing heavily in digital transformation projects.

The Benefits of Embracing Digital Financial Solutions

Companies can gain various benefits by adopting a digital financial system, e.g.:

- Improved efficiency: Process simplification and automation provide greater accuracy, lower costs and faster turnaround times.

- Enhanced customer experience: Improved customer satisfaction and loyalty can be achieved through personalized, always-available services and digital channels.

- Data-driven insights: Intelligent decision making based on data, risk management and opportunity recognition is enabled by advanced analytics.

- Competitive advantage: Financial institutions can develop new products and services thanks to digital transformation, helping them stay one step ahead of their competitors.

Bring your app concept to life right now and revolutionize the financial sector by reading our in-depth guide!

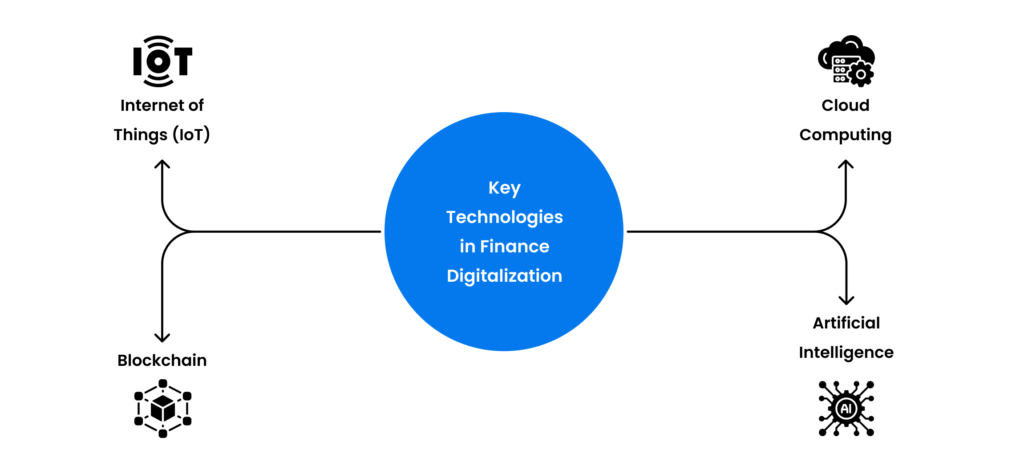

Key Technology in Finance Industry

Cloud Computing

Cloud computing has changed the way financial data is processed, accessed and stored. Financial institutions can offer scalable solutions that streamline operations, save costs, and strengthen data security through the use of cloud-based systems. Companies and consumers can spend their money with unprecedented ease and efficiency thanks to the availability of information anytime, anywhere

Artificial Intelligence (AI)

In the digital economy, artificial intelligence is leading the way by helping companies analyze big data faster and more accurately. The possibilities are endless, from AI-powered algorithms to chatbots that analyze market trends and deliver customer service. Clients and financial professionals alike benefit greatly from artificial intelligence (AI) that improves decision-making, automates repetitive transactions and delivers tailored financial advice

Blockchain

The way transactions are created and recorded is changing thanks to blockchain technology. Blockchain reduces the need for intermediaries, reduces fraud, provides a decentralized, secure and transparent ledger and increases trust in financial transactions In addition to cryptocurrencies, its applications can be used for supply chain finance, identity verification and smart contracts, opening the door to a more efficient financial environment

Internet of Things (IoT)

By connecting common objects to the Internet, the Internet of Things (IoT) opens up new possibilities for financial services. Imagine living in a future where your smart fridge can actually make purchases to manage your budget based on your spending habits. IoT devices have the ability to collect data in real-time, provide financial institutions with critical insights into the interests and behaviors of their customers, and ultimately develop specialized financial solutions.

Popular Digital Financial Tools

Online Banking

The days of waiting in huge lines at the bank are long gone. Now you can manage accounts, transfer funds and pay bills from the comfort of your home or mobile device through online banking. With just a few clicks, customers can manage their financial lives thanks to Internet banking’s user-friendly interfaces and robust security measures.

Mobile Wallets

The way we do business is evolving thanks to mobile wallets. With this digital wallet, customers can safely store their credit card details on their phones, making purchases in person, online, even among friends easier and faster Thanks to features such as fast and honest money transfers profitably, mobile wallets are rapidly replacing traditional financial systems awards.

Financial Planning Apps

Financial planning apps are designed to help users set and meet their financial goals. This service provides the knowledge and information needed to make smart financial decisions, whether it’s investing, budgeting, retirement or tracking savings. Financial planning apps provide users with personalized insights and recommendations that allow them to take control of their financial destiny.

Cryptocurrency Exchanges

Exchanges for cryptocurrencies have grown in importance as major markets for buying, selling, and trading cryptocurrencies as a result of the use of digital currencies. Customers can vary their investments and get more knowledge about blockchain technology with this exchange as it gives them access to a greater variety of digital assets. Thanks to adaptable networks and empowering security features, digital currency exchanges make it easier for both novice and seasoned investors to navigate the market.

Find out how to improve your development process with these tried-and-true methods! Reach new heights with your software projects by investigating the Software Development Life Cycle Best Practices.

How Digitalization Impacts Your Financial Life

Enhanced Convenience and Accessibility

Having access to your money 24/7 is one of the biggest benefits of digital finance. The days of waiting for bank hours to check your balance or make a transfer of cash are long gone. You may maintain an eye on your accounts, make payments, and manage your wealth with a few clicks on your smartphone from anywhere at any time. Better money management is made possible by this degree of accessibility, which also saves time.

Digital finance also features payments and transactions that are seamless. Digital platforms speed up and improve the speed of several tasks, such as sending money to friends, paying bills, and buying online. Users may now easily finish purchases thanks to the greater simplification of transactions brought about by the integration of contactless payments and digital wallets.

Also, customized financial services are starting to become standard. Financial institutions use data analytics to provide personalized advice based on your particular financial situation and objectives, helping you in making wise decisions. This degree of customization builds a stronger bond between clients and their financial providers and raises customer satisfaction.

Improved Security and Fraud Prevention

Modern security measures that safeguard your financial information are also brought about by digitization, which also increases ease. To protect customer information from breaches and illegal access, financial institutions are making major investments in cybersecurity systems.

Nowadays, it is common to have real-time fraud detection systems that examine transaction patterns and promptly notify consumers of any suspect activity. Giving customers peace of mind, this proactive approach to security makes sure that such risks are addressed before they get worse.

Also, information security and encryption technologies are important for protecting the privacy of financial transactions. Financial organizations may guard against illegal access and guarantee the security of your data by protecting important information.

Enhanced Financial Literacy and Education

Because digitalization makes financial education resources more accessible, it is also changing financial literacy. With a wealth of knowledge available on online and mobile platforms, individuals may study debt management, investing, and budgeting at their own speed. People may now make better decisions regarding finances as financial knowledge has become easier to acquire.

Even easier than ever to get personalized financial guidance. Numerous digital financial services offer customized insights and suggestions to its consumers, enabling them to safely navigate their financial journeys.

Another entertaining and interesting method of improving financial literacy is through gamified learning environments. Users may study finance in an interactive way that is both fun and efficient by adding game-like aspects to instructional resources.

Revolutionizing Business Finance

Streamlined Operations and Efficiency

Financial management automation is one of the biggest benefits of digitization in corporate finance. Using technologies like robotic process automation and artificial intelligence, businesses can streamline things like payroll, accounts payable and receivable, and billing Now, thanks to automation, employees can use them to focus on strategic tasks, which in turn saves time and reduces manual costs.

Another important benefit of digitization is data-driven decision-making. Companies are able to make fact-based decisions when they have the ability to collect and analyze large amounts of financial data in real time. Data-driven decision-making enables companies to improve their budgets and stay ahead of the competition, from forecasting revenue to identifying ways to save costs.

Implementing a digital economy also has significant advantages including the advantages of lower costs and fewer errors. Companies can reduce the potential for errors and the cost of prevention by automating processes and reducing manual input. Using cloud-based financial management solutions can also result in significant cost savings as on-site equipment and maintenance are not required.

Improved Risk Management and Compliance

Appropriate risk management is essential for long-term success in an evolving corporate environment. Enabling real-time risk assessment, digitization is transforming risk management reform. By using machine learning and advanced analytics, companies are able to identify potential risks and proactively address them. Real-time risk analytics enable companies to react quickly to changing market conditions and make informed decisions.

Automated compliance checks are yet another essential part of digital banking. Because financial rules are becoming more complicated, businesses need to make sure they follow exacting rules of compliance. By automating compliance inspections, digital technology can lower the risk of failure and guarantee that companies follow the law.

Similarly, improved accountability and transparency are two important advantages of automating company finance. Businesses may increase transparency throughout the company by centralizing financial data and automating procedures. Because financial choices and activities can be readily monitored and verified, transparency not only increases accountability but also creates confidence among stakeholders.

Enhanced Customer Experience

Businesses are now able to offer financial products and services tailored to each customer’s needs thanks to the digitization of the company’s finances. Companies can use data analytics and machine learning to gain insights into consumer preferences and behaviors to create customized financial solutions that meet the unique needs of their customers.

Another important component of digital finance is seamless consumer interactions. Businesses may give their consumers a convenient and uniform experience across all touchpoints by integrating digital platforms and channels. Customers may access financial services anytime, anyplace, using mobile applications and internet banking, which increases their loyalty and overall happiness.

Better convenience, customisation, and smoother interactions made possible by digitization also directly translate into higher consumer happiness. Strong connections and long-term success may be fostered by businesses by fulfilling the changing expectations of their consumers and giving them an exceptional experience.

Emerging Trends and Innovations

Open Banking

By enabling outside developers to create apps and services focused on financial institutions, open banking is completely changing the financial services sector. By encouraging competition and innovation, this trend gives customers access to a wider variety of financial solutions that are customized to meet their requirements. Banks may provide individualized services and eventually improve the client experience by securely exchanging data.

Decentralized Finance (DeFi)

DeFi, which stands for decentralized finance, is a unique concept that uses blockchain technology to eliminate the need for traditional intermediaries in financial systems. The DeFi system reduces costs while improving access by enabling users to borrow, lend and exchange assets directly with each other. This shift towards a decentralized system creates opportunities to democratize finance by reaching out to those who have not had access to traditional financial institutions.

Biometric Authentication

The importance of biometric authentication in banking is rising as security worries do. Enhancing security measures and streamlining the user experience are achieved by using unique biological qualities, such as speech patterns, facial recognition, or fingerprints. This technology makes communication secure and fast by streamlining financial transactions while protecting sensitive financial information.

Explore the Top Web Application Examples that are important to know and that affect the path of the digital world. Don't pass on the improvements that drive achievement!

Challenges and Opportunities

Data Privacy and Security Concerns

As digital money has grown, data security and privacy have become important. Safeguarding the huge amount of personal data that financial institutions gather and retain is essential. Businesses that want to protect consumer information and uphold trust must have strong cybersecurity safeguards in place and respect to legal requirements.

Regulatory Challenges

The rapid development of digital innovation sometimes exceeds the current legal structures, posing difficulties for dedication. The set of rules that financial institutions operate in is complicated and will depend on the technology and locality. Maintaining the expansion of digital banking will require innovation to be supported alongside keeping up with regulations.

Digital Divide and Financial Inclusion

Even with the developments in digital banking, there is still an important digital gap that prevents many people from having access to basic financial services. In order to advance financial equality and guarantee that everyone can take use of digital finance's benefits, closing this gap is essential. In areas with limited resources, efforts must be done to give inexpensive access to technology and financial education.

Conclusion

It is possible that implementing digital finance is now necessary for success as we navigate the constantly changing world of money. Adopting digital financial solutions has many important benefits that allow both people and organizations to improve their financial management procedures.

Summary of Key Advantages

- Enhanced Efficiency: Automation of financial processes streamlines operations, reduces errors, and saves valuable time.

- Improved Accessibility: Digital finance provides 24/7 access to financial services, allowing users to manage their finances anytime, anywhere.

- Personalized Services: Data-driven insights enable financial institutions to offer tailored products and services that meet individual needs.

- Robust Security: Advanced security measures, including biometric authentication and real-time fraud detection, protect sensitive financial information.

- Increased Financial Literacy: Accessible educational resources and personalized advice empower individuals to make informed financial decisions.

It's time for the banking industry to embrace the digital revolution. Adopting digital financial solutions may greatly improve your financial life, whether you are an individual seeking improved financial management tools or a corporation wishing to optimise operations. Examine the range of digital resources at your disposal, allocate funds towards financial literacy, and proactively incorporate these technology into your everyday routines.