Creating a Payment App with Seamless User Experience

Table of Contents

Creating a payment applications have completely changed how we do business. These applications offer speed, security, and convenience for tasks like online shopping, coffee payments, and bill splitting with friends.

The advancement in digital payments has changed the nature of trade and made smooth transactions available to millions of people worldwide. Due to the increasing use of smartphones and internet access, mobile payment applications have developed into essential daily tools.

Cashless transactions have become a recent trend as a result of their increased popularity due to its integration with contactless technologies, QR codes, and financial systems. As digital payments have developed over time, cash and conventional banking procedures have given way to quick, app-based transactions.

The ecosystem has been shaped, innovation has been powered, and safe, user-friendly experiences have been guaranteed by industry heavyweights such as banks, fintech companies, and IT behemoths.

Understanding How Payment Apps Work

Payment apps serve as digital wallets that enable users to link bank accounts, store money, and conduct transactions using credit and debit cards. These transactions may appear to happen instantly, yet each payment is handled securely and effectively thanks to a complex network of secure technology.

There are several techniques that operate in the background when a user begins to develop an app. To start the transaction, the user selects a payment option and inputs the recipient's information. The tool then verifies the user's identification via biometric authentication, PIN codes, or two-factor authentication. While authentication is being completed, the fee request is sent to the card community or financial institution for approval.

Once the transaction has been allowed, it is safely sent to the payment processor over encrypted channels. The settlement procedure then transfers money from the payer's account to the recipient's account, completing the transaction.

Several modern technologies are used to fuel this smooth procedure. Contactless payments are made possible by Near Field Communication (NFC), which connects cell phones and payment terminals. With only a brief scan, QR codes are now often utilized for retail transactions and peer-to-peer payments.

Blockchain technology is increasingly being used to provide decentralized payments, fraud reduction, and transparency. AI and machine learning help with transaction analysis, fraud detection, and personalized payment experiences. Tokenization and encryption protect user data by replacing sensitive information with secure digital tokens, ensuring that financial transactions are safe from online threats.

Types of Payment Applications

There are several types of payment applications, each meeting distinct user preferences and financial requirements.

1. Traditional Banking Payment Apps

Customers may use their mobile devices to pay bills, transfer money, and manage accounts thanks to the payment apps that several banks have put together. A smooth digital banking experience is ensured by these applications' improved security and integrated financial services.

2. Mobile Wallets

With systems like Apple Pay, Google Pay, and Samsung Pay—which function as mobile wallets—users may now shop card data and make contactless payments. These wallets improve security and make transactions safer for customers who are always on the go by using encryption and tokenization.

3. Peer-to-Peer (P2P) Payment Apps

Through applications like Venmo, PayPal, and Cash App, users may also send money right instantly to friends, family, or groups. Using them makes it easier to share funds, pay for offerings, and conduct quick cashless money transactions.

4. Cryptocurrency & Blockchain-Based Payment Apps

Payment programs for cryptocurrencies employ the blockchain era to enable decentralized transactions. Customers may send money or make purchases using virtual currencies like Bitcoin and Ethereum as an alternative to traditional banking systems thanks to platforms like Binance Pay and BitPay.

5. Buy Now, Pay Later (BNPL) Solutions

Customers can also use BNPL services like Klarna, Afterpay, and Affirm to make purchases and defer payments over time. The reason those applications have gained popularity in e-commerce is that they allow consumers to control their spending without suffering unanticipated financial difficulties.

Payment Application Architecture

Properly developed payment apps must have a robust backend architecture since it ensures clean transaction processing, scalability, and protection. Strong security measures and multi-element authentication are employed to protect customer data and prevent fraud.

Further, real-time transactions enabled by API connection with financial institutions and 1/3-birthday celebration agencies allow users to hyperlink their debts and make quick payments. Cloud computing is necessary to boost applications' scalability, or their capacity to handle increasing transaction volumes while maintaining high availability and overall performance.

Payment applications conform to corporate standards such as GDPR for individual privacy and PCI-DSS for information security so that you may fulfill your legal requirements. Following regulations is necessary when creating payment applications. Governments and financial institutions may enforce these regulations to protect consumers and prevent financial crimes.

Core Features of a Payment App

A successful software must include key features that increase user satisfaction, productivity, and protection.

- Secure User Authentication & Authorization: A successful software must include essential features that increase user enjoyment, productivity, and protection.

- Seamless Onboarding & KYC Verification: Biometric login, encryption, and aspect authentication ensure that only authorized users may access the service.

- Multiple Payment Methods: Simplifies user registration while maintaining respect to legal requirements.

- Instant Transactions & Money Transfers: Supports digital wallets, UPI, and credit and debit cards to meet the demands of a wide range of users.

- Transaction History & Detailed Reporting: Allows customers to send and receive money instantly and without any delays.

- Fraud Detection & Risk Management: Artificial intelligence (AI)-powered algorithms spot questionable activity and stop illegal transactions.

- User-Friendly UI/UX: Users of various technical skill levels may simply use the app thanks to its intuitive navigation and accessibility features.

- Multi-Currency Support & International Payments: Enables cross-border transactions for users with reduced conversion costs.

- Push Notifications & Customer Support: Notifies buyers of transactions, charge closure dates, and security alerts while simultaneously offering chatbots and helplines for assistance.

Creating a Payment App: Step-by-Step Guide

1. Market Research & Competitor Analysis

Understanding the nation of the sector is important before developing a pricing app. By researching competitors, identifying areas of customer suffering, and analyzing characteristics, a distinctive, competitive solution may be developed.

2. Defining Features & Functionalities

The app will fulfill user expectations and industry standards if the crucial parts, such as transaction speed, payment options, security layers, and user experience, are defined based on research.

3. Choosing the Right Technology Stack

The application's scalability and general performance depend on the databases, frameworks, and programming languages selected. Kotlin, Swift, and React Native are popular technologies for mobile payment apps.

4. Backend Development & Database Design

Transactions, authentication, and data storage require a scalable and secure backend. Using distributed databases and cloud-based architecture provides excellent availability and efficiency.

5. Front End Development Best Practices

An interface that is easy to use and intuitive is essential for engagement. Easy navigation, responsiveness to a variety of devices, and accessibility should be given top priority in the layout.

6. Payment Gateway & Processor Integration

By connecting with pricing gateways like Stripe, PayPal, or Razorpay, support for a wide range of payment methods and smooth transactions are guaranteed.

7. Ensuring Security & Compliance Standards

PCI-DSS, GDPR, and other regulatory standards must be followed in order to protect customer information and maintain compliance.

8. Testing, Debugging, and Quality Assurance

The software is thoroughly tested, including security audits, useful testing, and user experience testing, before it is made available to ensure that it is reliable and safe.

9. Deployment & Go-to-Market Strategies

After testing is over, optimal reach and acceptance are ensured by releasing the app on stores like Google Play and the App Store and then implementing a successful marketing plan.

Challenges in Developing a Payment App

1. Security & Data Protection Risks

Safety is the top priority while creating payment apps. As cyber dangers are ever-evolving, developers must use tokenization, encryption, and fraud detection technologies to protect user information and prevent illegal transactions.

2. Regulatory Compliance & Licensing Challenges

Payment apps have to keep up with financial regulations including GDPR, PCI-DSS, and national banking laws. To get the necessary approvals and traverse complex legal processes, it may be very costly and time-consuming.

3. Handling High Transaction Volumes & Scalability

Payment applications are looking for a reliable method to handle large volumes of transactions in real time without suffering any downtime as their user bases expand. Renovating performance requires building a strong cloud infrastructure and improving backend architecture.

4. User Trust & Fraud Prevention

Proactive fraud protection and transparent operations are necessary to gain users' trust. By incorporating real-time warnings and monitoring tools driven by AI, security measures may be improved and suspicious activity can be identified.

5. Cost of Development & Maintenance

Proactive fraud protection and transparent operations are necessary to gain users' trust. By integrating real-time warnings and monitoring tools driven by AI, security measures may be improved and suspicious activity can be identified.

Get the essential steps to build a secure, scalable, and user-friendly fintech app—fast and efficiently.

Cost of Developing a Payment App

A payment app's development cost is established by a number of variables, such as complexity, technological stack, security demands, and compliance requirements. UI/UX design, backend development, API integrations, and continuous maintenance are important cost factors.

Companies must choose between outsourcing development and assembling an internal team; each choice has financial advantages. Although outsourcing might save money, there may be issues with security and customisation. Cost-cutting techniques that don't sacrifice quality include using cloud solutions and giving priority to necessary features in the first stage.

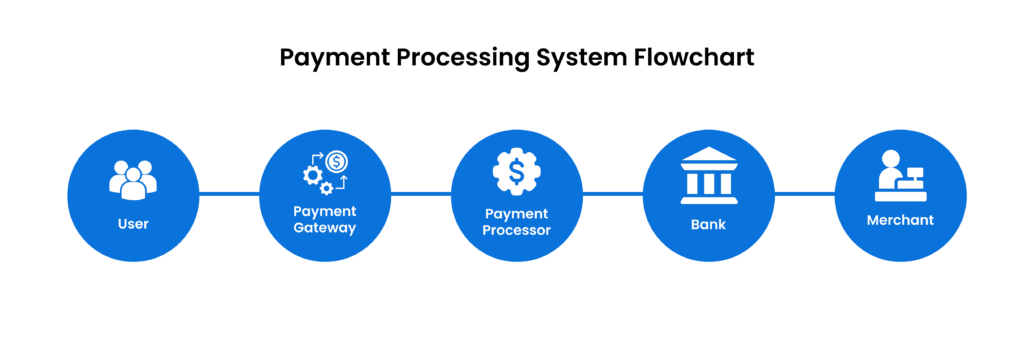

Understanding Payment Processing Systems

By guaranteeing that money is safely moved from the payer's account to the recipient's account, a payment processor acts as a middleman between banks, retailers, and consumers. The processor verifies payment information, looks for fraud, and gets in touch with banks to approve and complete a transaction that a consumer has started.

The safe link between a merchant and a payment processor is a payment gateway. Sensitive financial information is encrypted, protecting client information from online attacks. The gateway guarantees a safe and easy transaction start, while the payment processor manages approvals and settlements.

The payment process follows several steps:

- The customer enters their payment details.

- The payment gateway encrypts the data and forwards it to the processor.

- The processor communicates with the acquiring bank and card network.

- The issuing bank authorizes or declines the transaction.

- Once approved, the funds are deducted and settled in the recipient’s account.

Banks, card networks (Mastercard, Visa), and regulatory agencies are important in maintaining the integrity of the fee environment. They ensure conformity to financial regulations, protect you from fraud, and offer a reliable framework for cross-border transactions.

Developing a Custom Payment Processor

Why Build Your Own Payment Processor?

Companies may also choose to expand their own payment processors in order to lower transaction costs, increase control over pricing, and improve security. Custom payment processors enable agencies to customize their systems to meet specific business needs, ensuring smooth interactions with internal platforms and speedier transaction settlements.

Key Backend Components of a Payment Processor

A payment gateway for safe transaction initiation, a fraud detection tool to stop illegal transactions, and database control to protect transaction data are all components of a robust charge processor. Together, these components provide dependable and quick price processing.

Integrating with Financial Networks & APIs

Through API interfaces, a bespoke payment processor should establish connections with banks, credit score card networks, and regulatory agencies. In order to conduct transactions in accordance with criminal requirements, this involves establishing regular verbal communication channels with financial institutions.

Compliance & Security Considerations

Regulatory compliance is a crucial consideration when creating a price processor. Organizations need to follow PCI-DSS guidelines, implement end-to-end encryption, and regularly perform protection audits in order to prevent data breaches. Reputation and settlement in commercial transactions are ensured by meeting compliance criteria.

Challenges in Developing a Payment Processor

It takes a large investment in infrastructure, security, and license to build a payment processor. Assuring smooth integration with several payment methods, maintaining scalability for large transaction volumes, and securing regulatory permissions are some of the challenges. Continuous innovation and financial technology knowledge are necessary to overcome these challenges.

Creating Your Own Payment Gateway

1. Benefits of Developing a Custom Payment Gateway

By developing a customized payment gateway, businesses may customize transaction processing to their preferences, reducing transaction costs and reliance on third-birthday celebration suppliers. Additional control over user experience, security, and compliance is possible with a bespoke gateway, which also guarantees smooth connections with current banking systems.

2. Key Features of a Secure Payment Gateway

Multi-layer security protocols, tokenization, encryption, and fraud detection systems should all be supported by a great pricing gateway. A user-friendly dashboard that allows traders to successfully manage transactions should be included, along with real-time transaction processing and compatibility with many different charge methods.

3. Barriers & Challenges in Building a Payment Gateway

The challenges of expanding a charge gateway include obtaining regulatory approvals, establishing connections with other business networks, and making sure that safety regulations and PCI-DSS are followed. Agencies should also invest in infrastructure that can handle increased transaction volumes while maintaining high availability.

Steps to Develop a Secure & Scalable Payment Gateway

- Define Business Needs & Compliance Requirements: Establish regulatory compliance right away and identify the main transaction processing needs.

- Develop Core Payment Processing Infrastructure: Building a reliable and expandable backend that can handle and route transactions efficiently is important.

- Implement Security & Fraud Prevention Measures: To protect transactions, make use of tokenization, encryption, and AI-driven fraud detection.

- Integrate with Banking Networks & Payment Methods: Develop relationships with opportunity price systems, credit card networks, and financial institutions.

- Optimize for Performance & Scalability: Utilize cloud-based infrastructure to provide continuous performance, especially during periods of high transaction volume.

- Rigorous Testing & Quality Assurance: Before deploying the gateway, do extensive testing to ensure protection, dependability, and regulatory compliance.

Why Choose Patoliya Infotech for Money App Development?

1. Expertise in Fintech & Payment Solutions

Creating innovative financial solutions for companies of all sizes is Patoliya Infotech's specialty. We have a great deal of expertise with payment applications, so we know how difficult it is to create safe, scalable, and fast transaction systems.

2. Secure & Scalable Development Approaches

In order to secure data, we put industry-best encryption standards, fraud detection tools, and compliance tactics into practice at every stage of development. Our cloud-based design guarantees smooth scalability, allowing us to handle large transaction volumes without experiencing any downtime.

3. Customization & Feature-Rich Development

We develop completely unique payment applications that are suited to your company's requirements, in contrast to off-the-shelf options. We include cutting-edge technologies that improve user experience and security, whether you require a digital wallet, a peer-to-peer payment platform, or a BNPL solution.

4. Competitive Pricing & Post-Launch Support

We provide affordable development without sacrificing quality. With frequent updates, performance enhancements, and security fixes to keep your app operating at peak efficiency, our committed support staff guarantees seamless post-launch operations.

Conclusion

Blockchain-based transactions, AI-driven fraud protection, emerging trends, and more regulatory monitoring are all impacting the rapidly changing future of digital payments. To keep ahead of the competition in this cutthroat industry, entrepreneurs and agencies looking to grow a charging app should focus on security, scalability, and user experience.

By investing in a feature-rich, secure pricing solution, companies may enhance customer consideration, speed transactions, and exert pressure on the market. The next stage in creating a successful app is working with a skilled fintech development team, such as Patoliya Infotech, to ensure that your solution is built for long-term fulfillment in the always shifting financial sector.